We bring you the best possible solutions for your company.

EPR Registration for Plastic waste

Fullfill your responsibility towards environment.

A government-mandated program designed to make producers, importers, and brand owners of plastic products responsible for the entire lifecycle of their products, including their proper disposal and recycling. EPR is a crucial step towards reducing plastic pollution and promoting a sustainable environment.

Trusted by the world’s fastest growing companies:

Why Choose us.

EPR registration is a legal requirement for businesses involved in the production, import, or branding of plastic products. It signifies your commitment to environmental sustainability and compliance with regulations. It also allows you to actively contribute to the reduction of plastic waste and its harmful impact on the planet.

Environmental Commitment

We share your commitment to a greener planet and will guide you in fulfilling your EPR responsibilities effectively.

Expertise

Our team consists of EPR experts who understand the intricacies of EPR regulations, ensuring you navigate the process smoothly.

Efficiency

We streamline the registration and compliance process, saving you time and effort while ensuring adherence to legal requirements.

Sustainability

We can assist you in developing sustainable waste management strategies that benefit both your business and the environment.

How it works.

Avada has been a lifesaver for my growing business.

Morbi bibendum eu velit mattis aliquam. Nulla ac ullamcorper dui, in dictum nibh. Aliquam ac dictum nunc, eget auctor est.

Richard Simms

Founder – Hemisferio

Avada was the missing piece of the puzzle.

Morbi bibendum eu velit mattis aliquam. Nulla ac ullamcorper dui, in dictum nibh. Aliquam ac dictum nunc, eget auctor est.

Kate Schadler

Founder – Hemisferio

Great benefits from

Shree Incorporation

Reach out to us for tailored consulting solutions for your business needs. We simplify the process of registering for EPR for plastic waste.

Other Consulting Agencies

FAQ.

- All

- Ad code registration icegate

- Advance License Scheme

- apeda license

- Certificate of Origin

- Icegate Registration Services

- Import export code

- meis scheme

What is a Digital Signature Certificate (DSC)?

A Digital Signature Certificate (DSC) is a secure digital credential that confirms the identity of an individual or organization when conducting transactions online. Issued by a licensed Certifying Authority (CA), a DSC uses Public Key Infrastructure (PKI) to ensure data integrity, confidentiality, and authenticity. It enables secure eSigning, document verification, and online submissions with legal validity in India.

Is a Digital Signature legally valid in India?

Yes. Under the Information Technology Act, 2000, a Digital Signature Certificate is recognized as a legally valid method of signing documents electronically. DSCs can be issued, suspended, or revoked by government-authorized Certifying Authorities like eMudhra or Capricorn CA.

What classes of DSC are currently issued?

As per the latest CCA guidelines, only Class 3 Digital Signature Certificates are issued in India. Class 1 and Class 2 have been deprecated. Class 3 DSCs offer the highest level of security and are used for eTendering, MCA filings, GST returns, and EPFO applications.

What are the types of DSCs?

There are three major types of certificates:

Signature Certificate – Used to sign documents digitally.

Encryption Certificate – Used for encrypting documents to protect data.

Document Signer Certificate – Used by software systems to digitally sign bulk documents on behalf of an organization.

What documents are required for applying for a DSC?

For Individuals:

PAN Card, Aadhaar Card & Passport-size photograph

For Businesses:

Company PAN, Authorization letter & Director/Authorized Signatory ID proof

How can I apply for a DSC online with Shree Incorporation?

Our DSC application process is 100% paperless and Aadhaar-based: Fill out our quick DSC request form. Upload your documents online. Complete Aadhaar-based eKYC or video verification. Receive your DSC USB token by courier.

How long does it take to get a DSC issued?

Typically, it takes 15-20 minutes after successful document verification. Urgent processing is also available upon request.

How do I renew my DSC?

Renewing a DSC involves fresh identity verification as per CCA guidelines. We assist with simple online renewal — fill the form, re-upload KYC documents, and your new certificate will be issued within a day or two.

Where can I use a Digital Signature Certificate?

You can use your DSC for:

Filing GST returns on the GST portal, uploading forms to MCA21 (ROC filings), filing Income Tax returns, participating in Government e-Tendering, submitting claims on the EPFO portal, Authenticating contracts, invoices, and agreements electronically

Do I need a USB Token?

Yes. Your DSC will be securely stored in an encrypted USB token, also called a crypto token, which is required for all official DSC-based signatures.

Can I use DSC for multiple government portals?

Yes. A single valid Class 3 DSC can be used for:

GST Filing, MCA/ROC, EPFO, Income Tax, GeM, eProcurement Portals (NIC, MSTC, BHEL, etc.)

We also provide portal-specific guidance and token configuration support.

The duration of the APEDA registration process can vary depending on various factors, including the completeness of the application, the volume of applications received by APEDA, and the time taken for document verification. Generally, APEDA strives to process registrations efficiently and within a reasonable timeframe.

Once you have submitted the application, APEDA typically acknowledges the receipt of the application and provides a reference number. The document verification process and final approval may take anywhere from a few weeks to a couple of months, depending on the workload and internal processes of APEDA.

It is important to note that this timeline is just an estimate, and the actual duration may vary in individual cases. To get accurate information about the current processing time, it is recommended to refer to the official APEDA website or contact APEDA directly. They will be able to provide you with the most up-to-date information regarding the timeline for processing registrations.

APEDA offers various schemes and financial assistance programs to support and promote agricultural exports from India. Some notable schemes and financial assistance provided by APEDA include:

1. Market Development Assistance (MDA): This scheme aims to promote Indian agricultural products in international markets and support exporters in their market development efforts. Under MDA, financial assistance is provided for activities such as participation in trade fairs, exhibitions, buyer-seller meets, and export promotion seminars.

2. Infrastructure Development Assistance (IDA): The IDA scheme focuses on developing infrastructure facilities that aid in the export of agricultural products. Financial assistance is provided for the construction, upgradation, and modernization of cold storage chains, pack houses, pre-cooling facilities, and other infrastructure required for exports.

3. Quality Development Assistance (QDA): APEDA provides financial support under the QDA scheme to enhance the quality and safety standards of agricultural and processed food products. Assistance is offered for activities like setting up quality control laboratories, implementation of food safety standards, and obtaining certifications such as Hazard Analysis and Critical Control Points (HACCP), ISO, etc.

4. Transport Assistance: APEDA offers financial assistance for the transportation of eligible agricultural products from the place of production to the port of shipment. This assistance is aimed at reducing transportation costs and enhancing the competitiveness of Indian exporters in the international market.

5. Reimbursement of Registration Fees: Registered members of APEDA can avail reimbursement of fees paid for obtaining quality certifications like HACCP, ISO, Good Agricultural Practices (GAP), etc. This reimbursement helps in reducing the financial burden on exporters while ensuring compliance with quality standards.

6. Export Promotion Missions: Periodically, APEDA organizes export promotion missions to various countries to explore new market opportunities and establish business connections. Registered members may receive financial assistance for participation in these missions, enabling them to showcase their products and engage with potential buyers.

It’s important to note that the availability, criteria, and terms of these schemes and financial assistance may vary from time to time. Therefore, it is advisable to visit the official APEDA website or contact us to get most up-to-date information on the schemes and financial assistance programs.

The APEDA registration process involves several steps that need to be followed:

1. Determine Eligibility: Before starting the registration process, ensure that your business meets the eligibility criteria set by APEDA. Generally, any person or entity engaged in the production, manufacturing, or export of agricultural or processed food products can apply for APEDA registration.

2. Gather Documents: Collect all the required documents that are needed for registration. These typically include:

– PAN card

– Import-Export Code (IEC)

– Bank account details

– Memorandum/Articles of Association (in case of companies)

– Partnership deed (in case of partnerships)

– Proprietorship declaration (in case of proprietorships)

– Trade License/GST Certificate

– Rental agreement/Ownership proof of the premises

– List of products to be exported

3. Visit the APEDA Website: Go to the official APEDA website (apeda.gov.in) and navigate to the registration section. You can find the registration form and guidelines on the website.

4. Fill the Registration Form: Fill in all the necessary details in the registration form. This typically includes basic business information, contact details, IEC details, bank account information, product details, etc.

5. Upload Required Documents: Scan and upload all the required documents mentioned earlier. Ensure that the documents are in the prescribed format and meet the specified requirements regarding size, format, and clarity.

6. Payment of Registration Fees: Pay the applicable registration fees. The fee amount may vary based on the type of applicant (individual, company, etc.) and the nature of the business.

7. Submission of Application: Review the filled-in form and uploaded documents to ensure accuracy and completeness. Submit the application online through the APEDA website.

8. Acknowledgment and Tracking: After submission, you will receive an acknowledgment or reference number. This number can be used to track the status of your application.

9. Document Verification: APEDA will verify the submitted documents and cross-check the provided information.

10. Approval and Registration: Once the verification process is complete, APEDA will grant approval and issue the APEDA registration certificate. The registration certificate is valid for five years.

It is important to note that the registration process and requirements may be subject to changes or updates.

Therefore, it is advisable to refer to the official APEDA website or contact us directly for the most accurate and up-to-date information regarding the registration process.

There are several benefits to obtaining APEDA registration. Here are some key advantages:

1. Market Access: APEDA registration provides businesses with access to global markets for their agricultural and processed food products. By being registered with APEDA, exporters can take advantage of various schemes and initiatives that facilitate exports and promote their products in international markets.

2. Government Support: APEDA is a government organization under the Ministry of Commerce and Industry. Being registered with APEDA signifies that your business is recognized and supported by the government, which can enhance your credibility and reputation in the market.

3. Quality Assurance: APEDA is responsible for ensuring the quality and safety of agricultural and processed food products exported from India. As a registered member, your business will be subject to quality control measures and standards enforced by APEDA. This helps maintain product quality and instills confidence in buyers.

4. Market Promotion: APEDA actively promotes Indian agricultural products in international markets through various marketing and promotional activities. By being registered, your business can participate in trade fairs, exhibitions, and international marketing campaigns organized by APEDA, increasing your visibility and market reach.

5. Assistance with Export Procedures: APEDA provides support and guidance to exporters regarding export-related documentation, procedures, and certifications. Registered members can benefit from the expertise and resources offered by APEDA to navigate the complexities of international trade.

6. Financial Assistance: APEDA facilitates financial assistance schemes and programs for registered members to enhance their export capabilities. These schemes may include subsidies, grants, or incentives aimed at reducing export-related costs and promoting competitiveness in the global market.

7. Market Intelligence and Research: APEDA conducts research and provides market intelligence reports on various agricultural products and markets worldwide. This information can help registered exporters make informed decisions, identify potential markets, and adapt their strategies based on market trends and demands.

8. Networking Opportunities: APEDA organizes seminars, conferences, and trade meets where registered members can network and collaborate with industry stakeholders, including farmers, exporters, importers, and government officials. These networking opportunities can lead to valuable business partnerships and collaborations.

Overall, APEDA registration offers a range of benefits that can significantly boost your agricultural export business. It provides access to global markets, support from the government, quality assurance, promotional opportunities, export assistance, financial aid, market intelligence, and networking platforms. By becoming a registered member, you can leverage these advantages to expand your business and thrive in the international market.

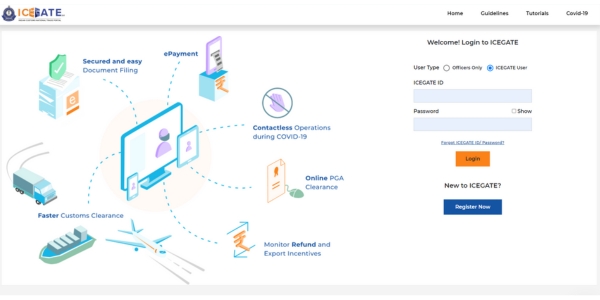

Throughout the ICEGATE registration process, users define various roles to effectively manage access & responsibilities within the system. These roles aim to ensure that individuals or entities possess the appropriate access levels and permissions required to execute trade tasks.

Below, we list some common user roles that may participate in the ICEGATE registration process:

Administrator: Responsible for managing and overseeing user accounts, permissions, and access to the ICEGATE system. Administrators hold the highest level of control and can assign other roles and privileges to users.

Importer/Exporter: These roles are designated for individuals or businesses engaged in importing or exporting goods. Importers utilize ICEGATE to file various customs documents for imports, while exporters employ it for their exports. They possess permissions to submit declarations, access shipment tracking, and manage their trade operations.

Additionally, Customs Brokers, who are authorized intermediaries acting on behalf of importers and exporters in customs-related matters. They use ICEGATE to submit customs declarations, documentation, and other pertinent information.

CHA (Customs House Agent): Customs House Agents, akin to customs brokers, aid importers and exporters in customs clearance processes. They may employ ICEGATE to facilitate clearance and submit necessary documents.

Warehouse Operator: Warehouse Operators oversee bonded warehouses where goods can be stored without immediate customs duty payment. They use ICEGATE to submit reports, declarations, and manage customs-related activities within these warehouses.

Shipping Line/Shipping Agent: Shipping Lines and Shipping Agents handle cargo transportation and logistics responsibilities. They use ICEGATE to submit advance information on shipments, coordinate customs-related activities, and manage container movements.

Furthermore, Transporters play a crucial role by providing advance information on goods in transit through various modes of transportation, such as road, rail, or air. This aids customs authorities in tracking the movement of goods.

Clearing House (CFS/ICD): Container Freight Stations (CFS) & Inland Container Depots (ICD) play pivotal role in cargo handling & consolidation. They may use ICEGATE to coordinate and oversee customs activities within their premises.

Consignee/Consignor: Consignees and Consignors represent parties involved in the shipment of goods. They may utilize ICEGATE to view and track the status of their shipments, access customs documentation, and manage trade-related tasks.

Supporting User: Supporting users encompass individuals or entities associated with any of the above roles. Offering additional assistance or support in customs and trade-related activities.

The specific roles and permissions within ICEGATE may differ depending on the customs regulations and procedures of various countries. Users typically must register for their respective roles, with their applications subject to approval by customs authorities before gaining access to and using the ICEGATE platform.

Icegate registration offers several benefits to individuals and businesses involved in import-export activities.

Here are some of the key advantages:

1. Streamlined Customs Clearance: Icegate registration provides access to a seamless and efficient customs clearance process. It eliminates the need for manual paperwork and reduces processing time, leading to quicker clearance of goods.

2. Enhanced Transparency: Icegate offers transparency in customs processes, enabling users to track their shipments and stay updated on their status in real-time. This visibility enhances accountability and reduces the risk of delays or errors.

3. Cost Reduction: By digitizing and automating processes, Icegate helps businesses save costs associated with manual paperwork, transportation, and storage. It also reduces the likelihood of penalties or fines due to compliance errors.

4. Improved Efficiency and Productivity: Icegate streamlines various workflows, enabling businesses to optimize their operations. This leads to improved productivity, reduced lead times, and faster turnaround on shipments, enhancing overall business efficiency.

5. Online Payment and Refund System: With Icegate, users can make online payments for customs duties, fees, and taxes. Additionally, the system offers a seamless process for claiming and receiving refunds, simplifying financial transactions.

6. Access to Trade Data: Icegate provides access to trade-related information and data, including imports and exports statistics, duty rates, trade agreements, and more. This data can be valuable for market research, planning, and identifying potential business opportunities.

7. Government Initiatives and Incentives: Icegate registration connects businesses to various government initiatives and incentives aimed at promoting trade, such as duty drawback schemes, export promotion programs, and customs benefits.

It is important to note that the specific benefits may vary based on the user category and purpose of registration.

The specific documents required for Icegate registration may vary based on the specific user category and purpose of registration. However, here are some commonly requested documents:

1. PAN card (Permanent Account Number)

2. Proof of identity (such as Aadhaar card, Passport, Voter ID, etc.)

3. Proof of address (such as Aadhaar card, Passport, Voter ID, etc.)

4. Proof of legal entity (such as Certificate of Incorporation, Partnership Deed, etc. for companies or firms)

5. Bank account details (such as a canceled cheque or bank statement)

6. Digital signatures (Class II or Class III, as required)

7. Importer-Exporter code (IEC) issued by the Directorate General of Foreign Trade (DGFT)

8. Authority Letter signed by Authorising Person (if applicable)

9. Authorized signatory details (kyc documents)

It is advisable to check the official Icegate website or get in touch with our support team for comprehensive and up-to-date information on the specific documents required for registration.

To obtain a Certificate of Origin, exporters typically need the following documents:

- Shipping bills

- Bill of Lading/Airway bill

- Invoice copy

- Packing list

It’s important to prepare these documents accurately, and having a Digital Signature Certificate for DGFT is essential. Registering on the CoO portal is mandatory for applying for a CoO.

Obtaining a Certificate of Origin can be a complex process, involving various documents and online applications. Our dedicated team is well-versed in the procedures and technicalities involved in obtaining CoOs, ensuring a smooth process for our clients.

The Merchandise Exports from India Scheme (MEIS Scheme) is an export incentive scheme introduced under the Foreign Trade Policy 2015-20, effective from April 1, 2015, until December 2020. MEIS aims to boost exports by offering incentives ranging from 2% to 7% of the FOB value of exports for specified products. This scheme helps make Indian goods competitive in global markets by offsetting export-related costs and infrastructural inefficiencies.

MEIS focuses on products with high export potential, job creation capacity, and the ability to enhance the competitiveness of Indian goods globally.

The duration of the IEC application process can vary depending on several factors, and it is important to note that this timeline is subject to change and may vary in individual cases. Generally, the process takes approximately 1 to 7 working days from the date of submission of the complete application.

However, it’s important to note that there are certain factors that can affect the timeline, such as the accuracy and completeness of the application, any additional documentation or clarifications requested by the Directorate General of Foreign Trade (DGFT), and the workload of the DGFT at the time of application.

To ensure a smooth and timely process, it is advisable to engage the services of an experienced IEC Consultant who can guide you through the application process, assist with the necessary documentation, and keep track of the progress of your application. Their expertise can help expedite the process and reduce any chances of unnecessary delays.

As your IEC Consultant, we will strive to provide prompt and efficient services, ensuring that your application is submitted accurately and in a timely manner. We will continuously track the progress of your application and provide you with updates and guidance throughout the process.

Yes, you can apply for an Import-Export Code (IEC) online.

The Government of India has introduced an online application process to make it more convenient for businesses and individuals to obtain an IEC.

To apply for an IEC online, you can follow these steps:

1. Visit the Directorate General of Foreign Trade (DGFT) website (https://dgft.gov.in/).

2. Register yourself on the DGFT website by creating an account. Provide the required details and create a login ID and password.

3. Once registered, log in to your account and select the ‘IEC’ tab or ‘Apply for IEC online’ option.

4. Fill in the online application form for an IEC. Provide the necessary details, such as personal or business information, PAN details, bank account information, and other relevant information.

5. Attach the required documents, such as PAN card copy, Address proof, Bank certificate or cancelled cheque, required documents and cancelled cheque, as mentioned earlier.

6. Review the application form and documents to ensure all information is accurate and complete.

7. Pay the applicable fees for the IEC application online through the provided payment gateway.

8. Submit the application form and documents online.

9. After successful submission, you will receive an Application Number or acknowledgment receipt.

10. The concerned authority will process your application, and upon approval, you will receive your IEC certificate via email or it can be downloaded from the DGFT website.

It’s important to note that certain categories of businesses may require additional documents or authorizations, such as those involved in restricted or regulated goods.

If you need assistance or further guidance in applying for an IEC online, feel free to reach out to us. We are here to help you through the process.

The fee structure for obtaining an IEC may vary depending on the type of application submitted to authority. Generally, the fees are as follows:

1. Application Fee: An application fee of Rs 500 is charged for processing new IEC application. The amount of this fee is charge only first time while applying for import export code from the issuing authority and can be paid via netbanking, debit card, credit card or upi.

2. Renewal Fee: Renewal fee of Rs 200 is charged only if iec is not renewed within same financial year. The amount of this fee is charge only when iec is deactivated and its needs to paid to activate and validate your existing import export code from the issuing authority and can be paid via netbanking, debit card, credit card or upi.

3. Modification / Updation Fee: Modification or updation fee of Rs 200 is charged only if any details in iec is required to be changed or updated. The amount of this fee is charge only when there is change in address, addition or deletion of partners, change in bank accounts etc. This amount needs to paid to update and validate your existing import export code from the issuing authority and can be paid via netbanking, debit card, credit card or upi.

4. Digital Signature Certificate (DSC): A digital signature is needed for the online submission and verification of the IEC application. The charges for obtaining a digital signature certificate are separate from the application fee and can vary based on the service provider.

5. Professional Consultancy Fees (Optional): If you choose to seek professional assistance from consultants or agencies, there may be additional consultancy fees involved. These fees will vary depending on the services provided and the level of assistance required.

It’s worth noting that fees may be subject to change, and it’s advisable to check the current fee structure with the relevant issuing authority or consult with a professional service provider for the most accurate and up-to-date information.

Should you require any further information or guidance regarding the fees associated with obtaining an IEC, please feel free to contact us. We are here to help and provide you with the necessary support.

To apply for an IEC, the following documents are typically required:

1. PAN Card: A copy of the Permanent Account Number (PAN) card of the individual or entity applying for the IEC.

2. Address Proof: An address proof document such as a copy of the Aadhaar card, passport, voter ID card, or driving license. This document is used to verify the applicant’s residential address.

3. Bank Certificate / Cancelled Cheque : A letter or certificate from the applicant’s bank confirming the bank account details mentioned in the application. This document serves as proof of the applicant’s bank account and is required for financial transactions related to import and export activities. Alternative cancelled cheque from the applicant’s bank account, featuring the account holder’s name and bank account details. This is required for verification of the bank account associated with the IEC application.

Please note that the exact set of documents may vary depending on the applicant’s category (individual, partnership, private company, etc.) and the issuing authority’s requirements.

W specialize in assisting businesses with the IEC application process. Our expert team can guide you through the documentation requirements, ensuring a smooth and hassle-free application experience.

Import Export Code is an essential requirement for businesses involved in international trade.

Here are some key advantages of obtaining an IEC:

1. Global Market Access: An IEC enables businesses to participate in global trade by allowing them to import and export goods and services to and from various countries. It opens up opportunities to explore new markets and establish international business relationships.

2. Legitimacy and Trust: Holding an IEC enhances the credibility and legitimacy of your business in the eyes of international clients, suppliers, and partners. It signifies that your operations are in compliance with the laws and regulations governing import-export activities.

3. Avail export incentives and benefits: Many export promotion schemes, benefits, and incentives are exclusively available to businesses with a valid IEC. These schemes can include duty drawback, tax exemptions, export subsidies, and government grants, which can significantly boost your profitability and competitiveness in the global market.

4. Easy Customs Clearance: Customs authorities require an IEC for customs clearance of imported and exported goods. Having an IEC streamlines the import-export process by ensuring efficient and hassle-free clearance of goods at ports and airports.

5. Easier International Bank Transactions: Banks require an IEC for international transactions related to imports and exports. Having an IEC makes it easier to conduct international payments, receive foreign currency, and avail of various financial services essential for international trade.

6. Brand Expansion and Diversification: An IEC allows businesses to expand their product offerings by importing goods and materials required for manufacturing or resell. It also opens avenues for diversifying business operations by exploring new markets and importing goods not readily available domestically.

We offer specialized consultancy services to assist businesses in obtaining Import Export Code.

Our expert team ensures a smooth and hassle-free application process, providing guidance on documentation, legal requirements, and other necessary formalities.